Today, we have a frontend that cuts across mobile app (OCB OMNI), online banking, and systems used by tellers.

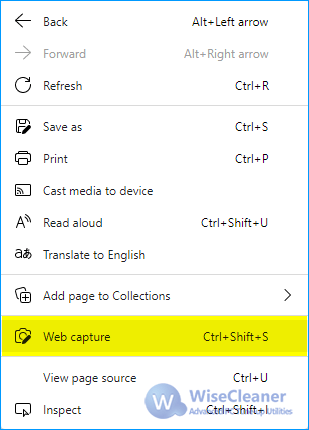

WEBPAGE CAPTURE WITH OCB UPGRADE

We upgrade our technology, no matter how small the requirement, every month. The enhancement of technology is a continuous process. What kind of technologies has OCB been investing in upgrading your banking system and services in recent years? How is the progress of implementing the digital core banking system to accommodate Internet banking payment services and digital payments at OCB at the moment? Our front end staff work seamlessly between digital touchpoints and physical ones. This has resulted in a significant enhancement of the customer experience we deliver. We are now selling insurance as well as investments through our mobile app – the OCB OMNI platform. We have unsecured pre-approved loans that are delivered and fulfilled through digital channels. Forty five percent of our credit cards are being sold exclusively through digital channels. Ninety percent of all new customers we acquire now have complete at least one online transaction in the first six months. This process has changed the way we do business. Today, I can confidently say that digitalisation and automation are part of our corporate DNA. We realised that it is so such more than just technology, it is also a mindset and a culture.

WEBPAGE CAPTURE WITH OCB FULL

We worked with well-established consultants to build out our roadmap and it took us a while to get full clarity on the digital transformation that we wanted to bring about. We put in a lot of effort to understand where we could harmonise our digital strategy with our ongoing business model which includes the physical network. So, we didn’t simply go around copying ideas from developed markets and implementing them. Sanjay Chakrabarty: Orient Commercial Bank was clear that our digital strategy had to be embedded in our core business. International Finance: Could you please share some facts and figures about the digital transformation process of OCB over recent years? How could these changes help improve your business performance last year? In an interview with International Finance, Sanjay Chakrabarty, deputy chief executive officer and head of retail banking at OCB describes the challenges faced in the bank’s digitalisation journey in Vietnam and how the bank is leveraging digital technology to bring the bank closer to the customer. Orient Commercial Bank was one of the first banks in Vietnam to embark on a digital transformation journey. Established in 1996, Orient Commercial Bank is one of Vietnam’s larger banks with nearly 5000 employees.

0 kommentar(er)

0 kommentar(er)